示例#

[1]:

# !pip install fracdiff

# !pip install matplotlib pandas pandas_datareader seaborn statsmodels

[2]:

import matplotlib.pyplot as plt

import numpy as np

import pandas as pd

import pandas_datareader

import seaborn

import statsmodels.tsa.stattools as stattools

from fracdiff import Fracdiff, FracdiffStat, fdiff

[3]:

seaborn.set_style("white")

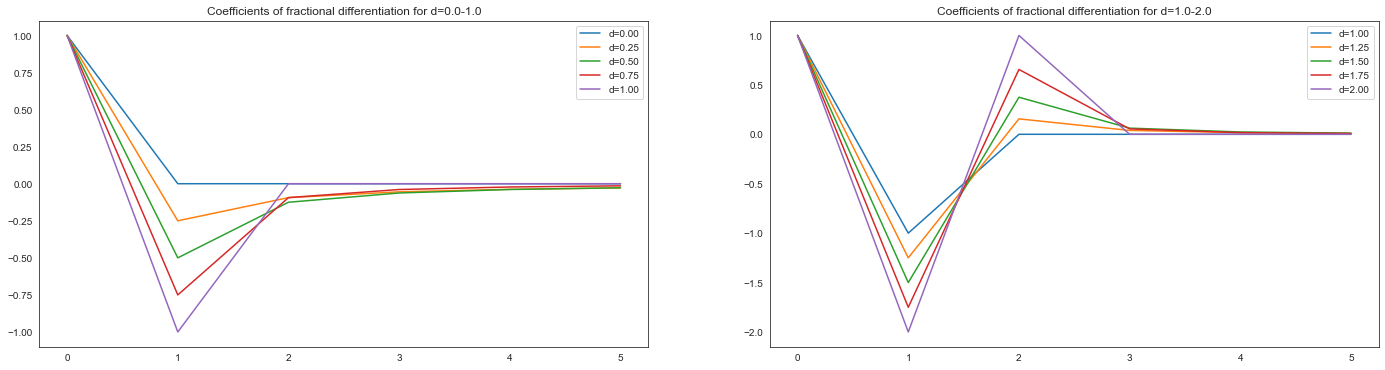

系数#

[4]:

from fracdiff.base import fdiff_coef

plt.figure(figsize=(24, 6))

plt.subplot(1, 2, 1)

plt.title("Coefficients of fractional differentiation for d=0.0-1.0")

for d in np.linspace(0.0, 1.0, 5):

plt.plot(fdiff_coef(d, 6), label=f"d={d:.2f}")

plt.legend()

plt.subplot(1, 2, 2)

plt.title("Coefficients of fractional differentiation for d=1.0-2.0")

for d in np.linspace(1.0, 2.0, 5):

plt.plot(fdiff_coef(d, 6), label=f"d={d:.2f}")

plt.legend()

plt.show()

S&P 500#

[5]:

def fetch_yahoo(ticker, begin="1998-01-01", end="2020-09-30"):

"""Return pandas.Series."""

return pandas_datareader.data.DataReader(ticker, "yahoo", begin, end)["Adj Close"]

def fetch_fred(ticker, begin="1998-01-01", end="2020-09-30"):

"""Return pandas.Series."""

return pandas_datareader.data.DataReader(ticker, "fred", begin, end).iloc[:, 0]

[6]:

spx = fetch_yahoo("^GSPC")

spx.head()

[6]:

Date

1997-12-31 970.429993

1998-01-02 975.039978

1998-01-05 977.070007

1998-01-06 966.580017

1998-01-07 964.000000

Name: Adj Close, dtype: float64

[7]:

spx.shape

[7]:

(5725,)

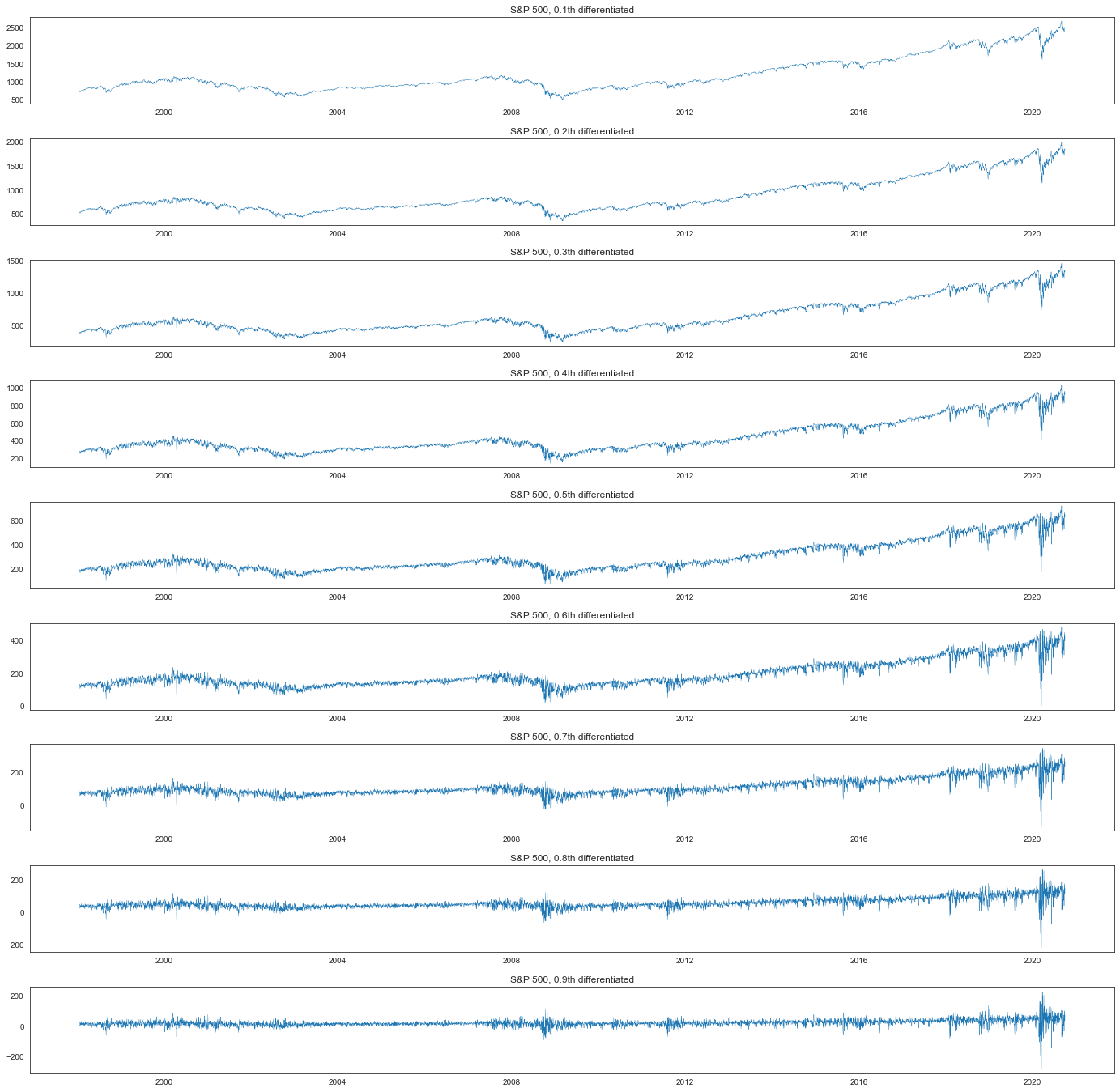

绘制分数差分#

[8]:

plt.figure(figsize=(24, 24))

plt.tight_layout()

plt.subplots_adjust(hspace=0.4)

for i, d in enumerate(np.linspace(0.1, 0.9, 9)):

diff = fdiff(spx, d, mode="valid")

diff = pd.Series(diff, index=spx.index[-diff.size :])

plt.subplot(9, 1, i + 1)

plt.title(f"S&P 500, {d:.1f}th differentiated")

plt.plot(diff, linewidth=0.4)

plt.show()

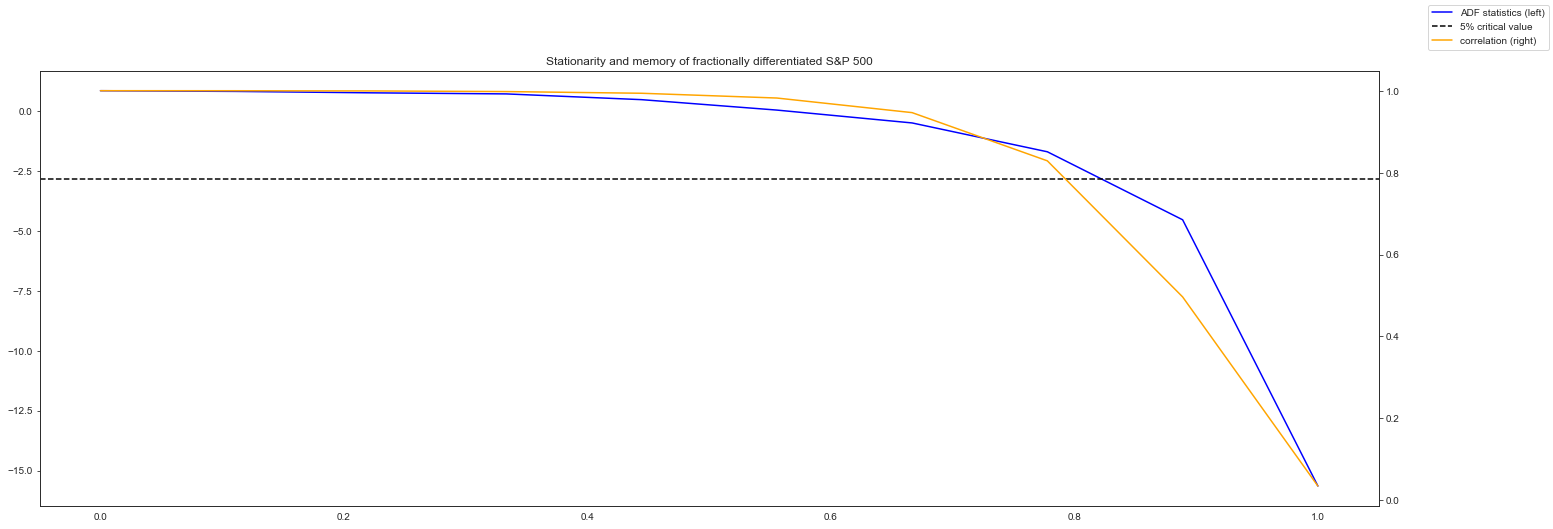

fracdiff 的平稳性#

[9]:

def adfstat(d): # noqa: D103

diff = fdiff(spx, d, mode="valid")

stat, *_ = stattools.adfuller(diff)

return stat

def correlation(d): # noqa: D103

diff = fdiff(spx, d, mode="valid")

corr = np.corrcoef(spx[-diff.size :], diff)[0, 1]

return corr

ds = np.linspace(0.0, 1.0, 10)

stats = np.vectorize(adfstat)(ds)

corrs = np.vectorize(correlation)(ds)

# 5% critical value of stationarity

_, _, _, _, crit, _ = stattools.adfuller(spx)

# plot

fig, ax_stat = plt.subplots(figsize=(24, 8))

ax_corr = ax_stat.twinx()

ax_stat.plot(ds, stats, color="blue", label="ADF statistics (left)")

ax_corr.plot(ds, corrs, color="orange", label="correlation (right)")

ax_stat.axhline(y=crit["5%"], linestyle="--", color="k", label="5% critical value")

plt.title("Stationarity and memory of fractionally differentiated S&P 500")

fig.legend()

plt.show()

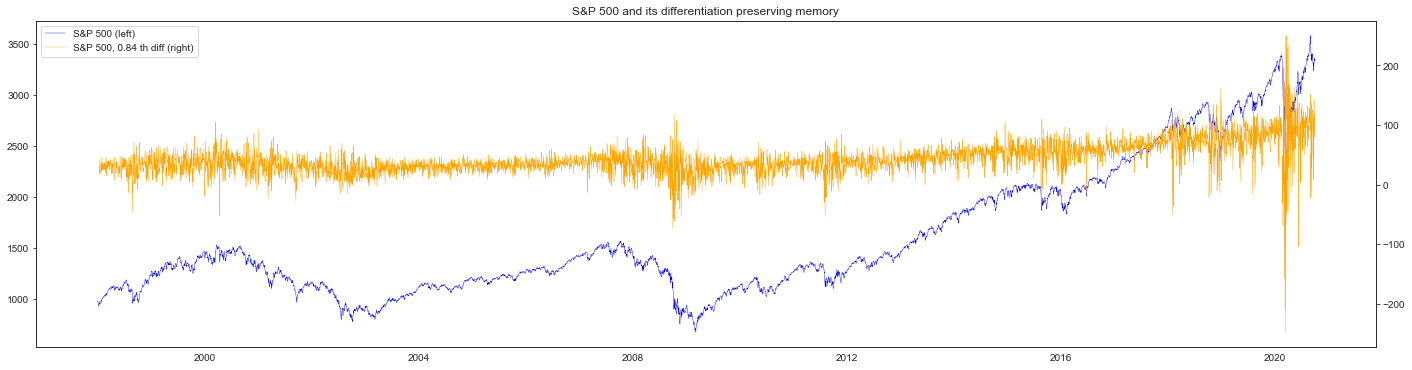

在保留内存的同时进行微分#

[10]:

X = spx.values.reshape(-1, 1)

fs = FracdiffStat(mode="valid")

Xdiff = fs.fit_transform(X)

_, pvalue, _, _, _, _ = stattools.adfuller(Xdiff.reshape(-1))

corr = np.corrcoef(X[-Xdiff.size :, 0], Xdiff.reshape(-1))[0][1]

print(f"* Order: {fs.d_[0]:.2f}")

print(f"* ADF p-value: {100 * pvalue:.2f} %")

print(f"* Correlation with the original time-series: {corr:.2f}")

* Order: 0.84

* ADF p-value: 3.41 %

* Correlation with the original time-series: 0.66

[11]:

spx_diff = pd.Series(Xdiff.reshape(-1), index=spx.index[-Xdiff.size :])

fig, ax_s = plt.subplots(figsize=(24, 6))

plt.title("S&P 500 and its differentiation preserving memory")

ax_d = ax_s.twinx()

plot_s = ax_s.plot(spx, color="blue", linewidth=0.4, label="S&P 500 (left)")

plot_d = ax_d.plot(

spx_diff,

color="orange",

linewidth=0.4,

label=f"S&P 500, {fs.d_[0]:.2f} th diff (right)",

)

plots = plot_s + plot_d

ax_s.legend(plots, [p.get_label() for p in plots], loc=0)

plt.show()

其他财务数据#

[12]:

nt_yahoo = [

("S&P 500", "^GSPC"),

("Nikkei 225", "^N225"),

("Shanghai Comp", "^SSEC"),

("US 10y", "^TNX"),

("Apple", "AAPL"),

]

nt_fred = [

("USD/JPY", "DEXJPUS"),

("Gold", "GOLDPMGBD228NLBM"),

("Crude Oil", "DCOILWTICO"),

]

dfy = pd.DataFrame({name: fetch_yahoo(ticker) for name, ticker in nt_yahoo})

dff = pd.DataFrame({name: fetch_fred(ticker) for name, ticker in nt_fred})

prices = pd.concat([dfy, dff], axis=1).fillna(method="ffill").loc["1998-01-05":]

[13]:

prices

[13]:

| S&P 500 | Nikkei 225 | Shanghai Comp | US 10y | Apple | USD/JPY | Gold | Crude Oil | |

|---|---|---|---|---|---|---|---|---|

| 1998-01-05 | 977.070007 | 14956.839844 | 1220.473022 | 5.498 | 0.122484 | 133.99 | 284.40 | 16.95 |

| 1998-01-06 | 966.580017 | 14896.400391 | 1233.619995 | 5.473 | 0.146113 | 133.88 | 282.80 | 16.64 |

| 1998-01-07 | 964.000000 | 15028.169922 | 1244.069946 | 5.527 | 0.135022 | 131.70 | 281.60 | 16.91 |

| 1998-01-08 | 956.049988 | 15019.179688 | 1237.162964 | 5.465 | 0.140326 | 132.49 | 281.65 | 17.01 |

| 1998-01-09 | 927.690002 | 14995.099609 | 1239.901001 | 5.379 | 0.140326 | 131.52 | 278.70 | 16.65 |

| ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 2020-09-24 | 3246.590088 | 23087.820312 | 3331.521973 | 0.666 | 108.220001 | 105.42 | 1861.75 | 40.11 |

| 2020-09-25 | 3298.459961 | 23204.619141 | 3331.521973 | 0.659 | 112.279999 | 105.59 | 1859.70 | 40.06 |

| 2020-09-28 | 3351.600098 | 23511.619141 | 3331.521973 | 0.663 | 114.959999 | 105.50 | 1864.30 | 40.47 |

| 2020-09-29 | 3335.469971 | 23539.099609 | 3331.521973 | 0.645 | 114.089996 | 105.68 | 1883.95 | 39.03 |

| 2020-09-30 | 3363.000000 | 23185.119141 | 3331.521973 | 0.677 | 115.809998 | 105.58 | 1886.90 | 40.05 |

5933 rows × 8 columns

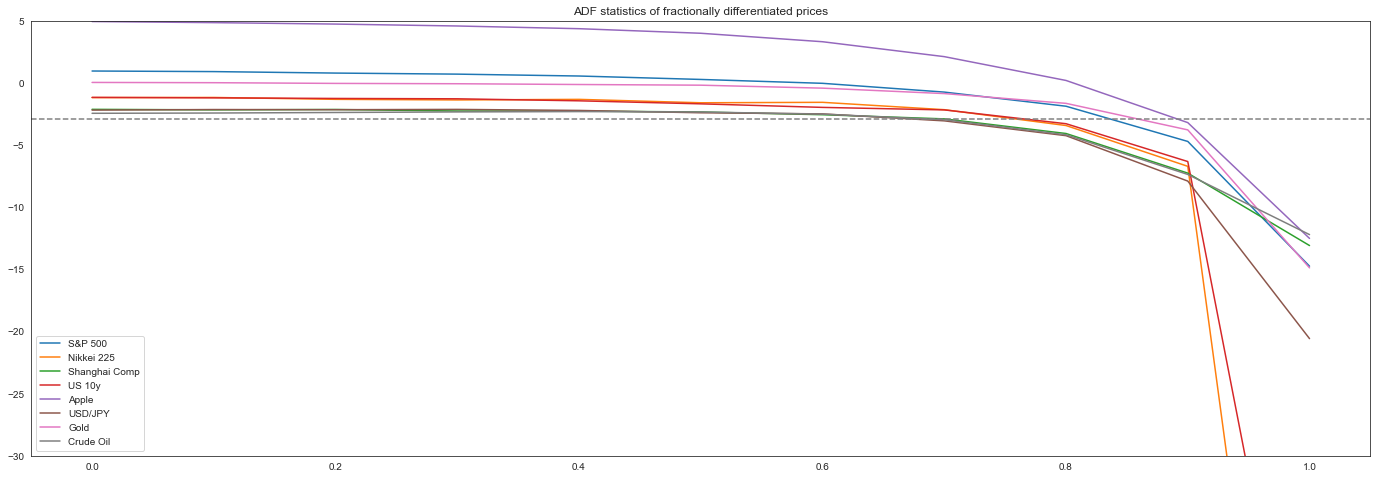

[14]:

def stats(X): # noqa: D103

return [stattools.adfuller(X[:, i])[0] for i in range(X.shape[1])]

ds = np.linspace(0.0, 1.0, 11)

df_stats = pd.DataFrame(

[stats(Fracdiff(d, mode="valid").fit_transform(prices.values)) for d in ds],

index=ds,

columns=prices.columns,

)

df_stats

[14]:

| S&P 500 | Nikkei 225 | Shanghai Comp | US 10y | Apple | USD/JPY | Gold | Crude Oil | |

|---|---|---|---|---|---|---|---|---|

| 0.0 | 0.968324 | -1.170435 | -2.116867 | -1.153880 | 4.951773 | -2.178117 | 0.049131 | -2.434859 |

| 0.1 | 0.921352 | -1.159694 | -2.157641 | -1.191706 | 4.862630 | -2.132538 | 0.028313 | -2.412764 |

| 0.2 | 0.802339 | -1.311269 | -2.128508 | -1.240243 | 4.745854 | -2.145354 | -0.028585 | -2.369947 |

| 0.3 | 0.717212 | -1.359395 | -2.250318 | -1.268093 | 4.592151 | -2.120619 | -0.055576 | -2.324401 |

| 0.4 | 0.565597 | -1.313894 | -2.257933 | -1.430662 | 4.374133 | -2.204098 | -0.117716 | -2.297110 |

| 0.5 | 0.290000 | -1.587270 | -2.328407 | -1.673761 | 4.006742 | -2.392610 | -0.172077 | -2.330552 |

| 0.6 | -0.022086 | -1.551456 | -2.549346 | -1.959220 | 3.325249 | -2.481928 | -0.410898 | -2.502265 |

| 0.7 | -0.728352 | -2.142965 | -2.883885 | -2.162136 | 2.125019 | -3.043593 | -0.847778 | -2.952382 |

| 0.8 | -1.865212 | -3.419540 | -4.061263 | -3.273391 | 0.207860 | -4.235373 | -1.633992 | -4.159692 |

| 0.9 | -4.699825 | -6.702866 | -7.249331 | -6.317477 | -3.184654 | -7.890231 | -3.769678 | -7.355233 |

| 1.0 | -14.739458 | -79.308045 | -13.078267 | -56.638622 | -12.503627 | -20.568982 | -14.873720 | -12.198547 |

[15]:

_, _, _, _, crit, _ = stattools.adfuller(prices["S&P 500"].values)

df_stats.plot(figsize=(24, 8), ylim=(-30, 5))

plt.axhline(y=crit["5%"], linestyle="--", color="gray")

plt.title("ADF statistics of fractionally differentiated prices")

plt.show()

[ ]:

使用 nbsphinx 生成。Jupyter 笔记本可以在这里找到。